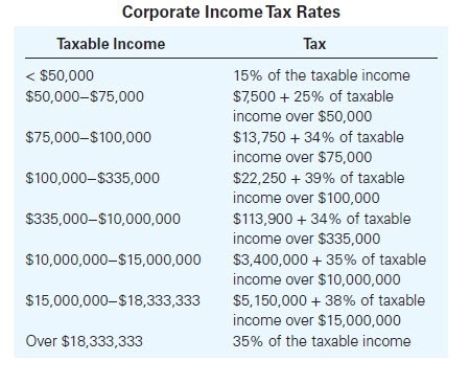

In its first year of existence Aspen Corp. (a C corporation) reported a loss for tax purposes of$50,000. In year 2, it reports a $30,000 loss. For year 3, it reports taxable income from operations of$120,000. How much tax will Aspen Corp. pay for year 3? Consult the corporate tax rate table provided to calculate your answer. (Use Corporate Tax Rate Schedule.)

Definitions:

Articulates

Refers to the way two bone surfaces move against each other at a joint.

Clavicle

A long bone that serves as a strut between the shoulder blade and the sternum, also known as the collarbone.

Anatomical Description

involves detailing the structure, position, and relationships of body parts to one another.

Olecranon Fossa

A large depression located on the posterior aspect of the humerus, accommodating the olecranon of the ulna when the arm is extended.

Q7: Superior Corporation reported taxable income of $1,000,000

Q35: Occasionally bonus depreciation is used as a

Q43: Employees who are at least 50 years

Q63: The gain or loss realized on the

Q69: Which of the following is not true

Q69: In 2017, Madison is a single taxpayer

Q82: Evergreen Corporation distributes land with a fair

Q92: When employees contribute to a traditional 401(k)

Q109: Jacob participates in his employer's defined benefit

Q135: In January 2016, Khors Company issues nonqualified