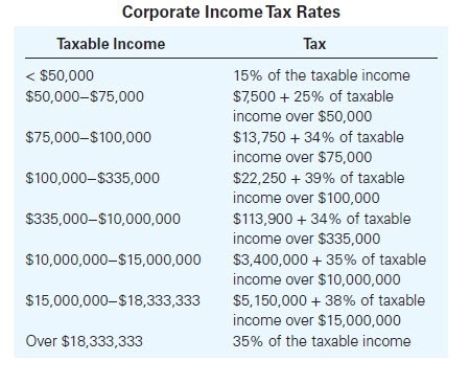

In its first year of existence Aspen Corp. (a C corporation) reported a loss for tax purposes of$50,000. In year 2, it reports a $30,000 loss. For year 3, it reports taxable income from operations of$120,000. How much tax will Aspen Corp. pay for year 3? Consult the corporate tax rate table provided to calculate your answer. (Use Corporate Tax Rate Schedule.)

Definitions:

Wholesale Price

The cost at which goods are sold by wholesalers to retailers or distributors, generally lower than retail prices.

Larger Quantities

Denotes the procurement, production, or offering of goods in amounts greater than usual.

Strategic Partners

Businesses or entities that collaborate through agreements or alliances to achieve common goals, share resources, or enhance competitive advantages.

Supply Chain Intermediaries

Entities that act as middlemen in the distribution process from manufacturer to consumer, such as wholesalers and retailers.

Q9: Oriole, Inc. decided to liquidate its wholly-owned

Q10: Lauren purchased a home on January 1,

Q15: Employees will always prefer to receive incentive

Q16: If certain conditions are met, an apartment

Q27: Which legal entity is generally best suited

Q31: On March 31, year 1, Mary borrowed

Q46: In 2014, Smith Traders Inc. reported taxable

Q69: The rules for consolidated reporting for financial

Q82: Rachelle transfers property with a tax basis

Q130: Which of the following describes the correct