To be indifferent between investing in the two bonds, the Moe's, Inc. bond should provide Namratha t same after-tax rate of return as the city of Watkinsville bond (4.5%). To solve for the required pre-tax rate of return we can use the following formula: After-tax return = Pre-tax return × (1 - Marginal Tax Rate).

Moe's, Inc. needs to offer a 6% interest rate to generate a 4.5% after-tax return and make Namratha indifferent between investing in the two bonds.

4.5% = Pre-tax return × (1 - 25%); Pre-tax return = 4.5%/(1 - 25%) = 6%

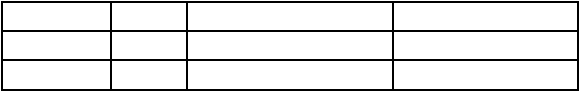

-Given the following tax structure, what is the minimum tax that would need to be assessed on Dora to make the tax progressive with respect to average tax rates? What is the minimum tax that would need to beassessed on Dora to make the tax progressive with respect to effective tax rates?  Taxpayer Salary Muni-Bond Interest Total TaxDiego 30,000 10,000 1,500Dora 50,000 5,000 ???

Taxpayer Salary Muni-Bond Interest Total TaxDiego 30,000 10,000 1,500Dora 50,000 5,000 ???

Definitions:

Homosexual Orientation

The enduring pattern of emotional, romantic, and/or sexual attractions to individuals of the same sex.

Intimate Relationships

Intimate relationships are deeply personal connections between individuals, characterized by love, trust, understanding, and emotional closeness.

Stable Relationship

A relationship characterized by continuity, reliability, and emotional stability between partners over time.

Bisexual

A sexual orientation describing individuals who are attracted to both male and female genders.

Q2: One primary purpose of equity compensation is

Q12: Explain whether the sale of a machine

Q21: Implicit taxes are indirect taxes on tax-favored

Q22: Which of the following is true regarding

Q27: Andrew, an individual, began business four years

Q59: Which of the following statements is true

Q59: Stock that is retired is the same

Q74: A company's debt-to-equity ratio was 1.0 at

Q77: Flax, LLC purchased only one asset this

Q143: A corporation declared and issued a