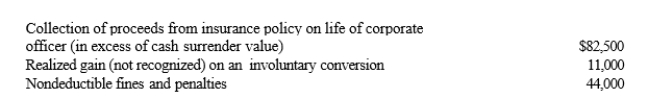

Silver Corporation, a calendar year taxpayer, has taxable income of $550,000.Among its transactions for the year are the following:  Disregarding any provision for Federal income taxes, Silver Corporation's current E & P is:

Disregarding any provision for Federal income taxes, Silver Corporation's current E & P is:

Definitions:

Percentage of Sales Budgeting

A method of budgeting where marketing and other expenses are based on a fixed percentage of sales revenue.

Objective and Task Budgeting

A budgeting method that involves defining specific marketing objectives and the costs associated with achieving them.

Promotion Objectives

The specific goals that a company aims to achieve through its promotional activities, such as increasing brand awareness, generating leads, or boosting sales.

Promotion Cost

Expenses associated with marketing and selling a product, including advertising, public relations, and promotional materials.

Q5: During the current year, Khalid was in

Q21: Lent Corporation converts to S corporation status

Q30: Chad pays the medical expenses of his

Q34: The recognized gain for regular income tax

Q44: Limited partnership<br>A)Organizational choice of many large accounting

Q66: Maria and Christopher each own 50% of

Q68: The Section 179 expense deduction is a

Q74: In general, the basis of property to

Q89: If an individual does not spend funds

Q100: A partnership will take a carryover basis