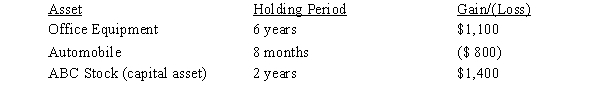

The following assets in Jack's business were sold in 2018:  The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2018 the year of sale), Jack should report what amount of net capital gain and net ordinary income?

The office equipment had a zero adjusted basis and was purchased for $8,000.The automobile was purchased for $2,000 and sold for $1,200.The ABC stock was purchased for $1,800 and sold for $3,200.In 2018 the year of sale), Jack should report what amount of net capital gain and net ordinary income?

A)$1,700 LTCG.

B)$600 LTCG and $300 ordinary gain.

C)$1,400 LTCG and $300 ordinary gain.

D)$2,500 LTCG and $800 ordinary loss.

E)None of the above.

Definitions:

Limitations

Restrictions or constraints that limit or define the boundaries of possibilities or actions.

Justification of Effort Effect

A cognitive bias that leads individuals to value an outcome more if they had to put effort into achieving it.

Therapeutic Alliance

The collaborative and trusting relationship between a therapist and client, considered essential for effective therapy.

Placebo Effect

A phenomenon in which a person experiences a perceived improvement in condition due to their expectations, rather than the effect of an active medical treatment.

Q9: Matt, a calendar year taxpayer, pays $11,000

Q20: Richard, age 50, is employed as an

Q48: The cost of repairs to damaged property

Q67: When separate income tax returns are filed

Q80: Once they reach age 65, many taxpayers

Q83: Using borrowed funds from a mortgage on

Q86: Lee, a citizen of Korea, is a

Q97: To compute the holding period, start counting

Q125: A deduction for parking and other traffic

Q131: Sandra acquired a passive activity three years