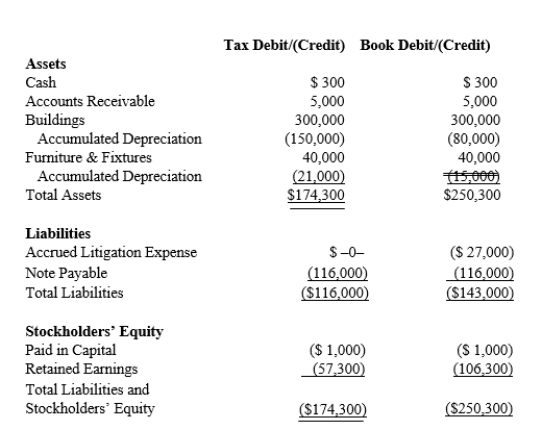

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 21% corporate tax rate and no valuation allowance.

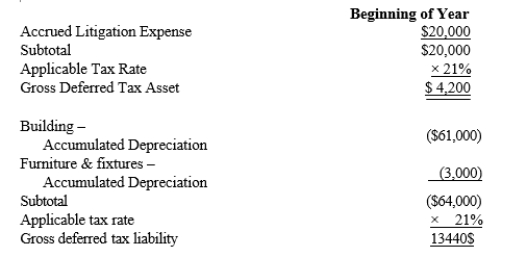

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense.Determine the net deferred tax asset or net deferred tax liability at year end.

Definitions:

Psychotherapy

A treatment method involving psychological techniques designed to assist individuals in overcoming difficulties or achieving personal insight.

Church Doctrine

Official teachings and beliefs sanctioned by a religious institution, particularly within Christianity.

Possession

The state of having, owning, or controlling something, or in some contexts, a state in which a person is believed to be influenced or controlled by an external entity.

Nervous Breakdown

A non-medical term that signifies a period of intense mental distress, where an individual is unable to function normally in everyday life.

Q9: The expected period of time that will

Q33: If a taxpayer has a business with

Q33: ASC 740 addresses how an entity should

Q40: When evaluating a proposal by use of

Q52: On transfers by death, the Federal government

Q57: With respect to the prepaid income from

Q69: Rules of tax law do not include

Q81: Assume in analyzing alternative proposals that Proposal

Q120: The manager of a profit center does

Q175: Discuss the tax treatment of non-reimbursed losses