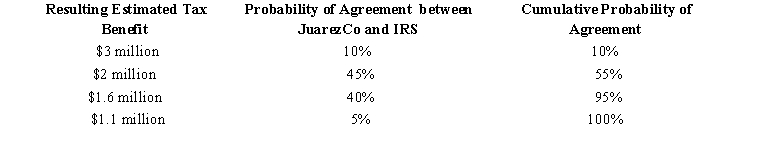

JuarezCo constructs the following table in determining how to apply ASC 740-10 to its filing position for the domestic production activities deduction.Its book tax provision for the year, including $3 million for the uncertain transfer pricing issue, is $10 million.  Under ASC 740-10, JuarezCo's book income tax expense for this item is:

Under ASC 740-10, JuarezCo's book income tax expense for this item is:

Definitions:

Loss On Sale

The financial loss that occurs when the selling price of an asset is less than its carrying amount at the time of sale.

Operating Activity

Activities that constitute the primary or main activities of an organization, such as sales or services.

Investment In Subsidiary

The purchase of shares or interests in a subsidiary company by a parent company to obtain control or significant influence over the subsidiary's management and operations.

Book Value

The net value of an asset as recorded on the balance sheet, calculated as the asset's cost minus accumulated depreciation.

Q2: A GAAP financial statement includes footnotes that:<br>A)Give

Q4: Rita earns a salary of $150,000, and

Q35: An inheritance tax is a tax on

Q52: What administrative release deals with a proposed

Q57: A CFO probably prefers a tax planning

Q58: Revenue tax measures typically originate in the

Q69: Doug and Pattie received the following interest

Q94: The first budget to be prepared is

Q107: Rustin bought 7-year class property on May

Q174: Marge sells land to her adult son,