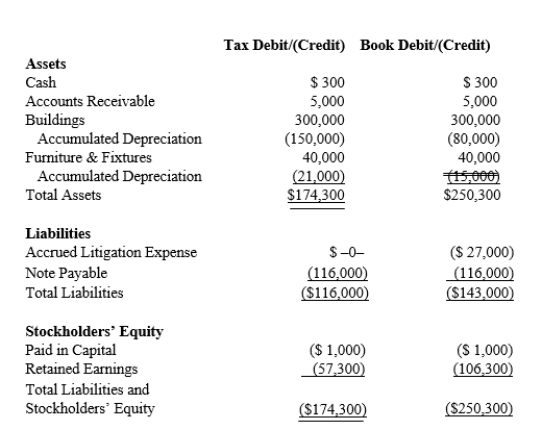

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 21% corporate tax rate and no valuation allowance.

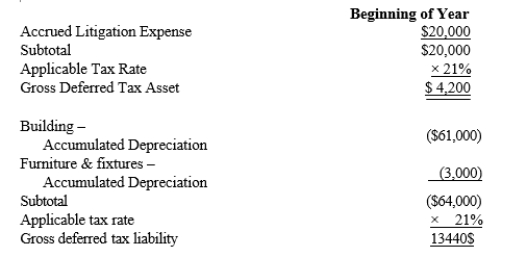

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense.Determine the net deferred tax asset or net deferred tax liability at year end.

Definitions:

Void

An empty space; a vacuum or gap.

Interstitial Cystitis

A chronic condition causing bladder pressure, bladder pain, and sometimes pelvic pain.

Renal Colic

Severe pain in the lower back or sides, often caused by kidney stones or other obstructions in the urinary tract.

Cystitis

Inflammation of the bladder, often caused by a urinary tract infection.

Q3: Supervisor salaries, maintenance, and indirect factory wages

Q3: Maple Company purchases new equipment 7-year MACRS

Q12: Discuss the application of the "one-year rule"

Q38: The principal objective of the FUTA tax

Q46: What statement is not true with respect

Q55: On January 5, 2018, Tim purchased a

Q57: The sales, operating income, and invested

Q61: When Betty was diagnosed as having a

Q66: In 2018, Liam invested $100,000 for a

Q98: The ratio of operating income to sales