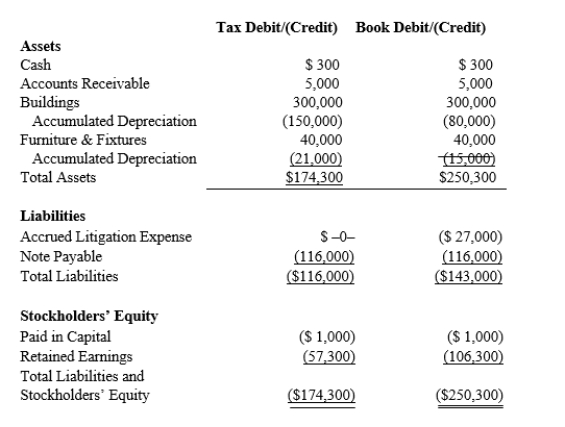

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 21% corporate tax rate and no valuation allowance.

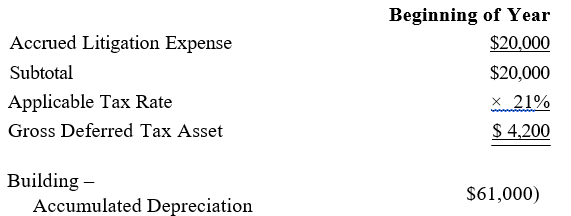

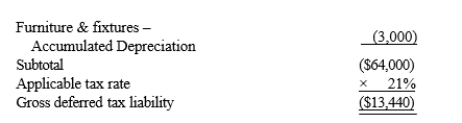

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense.Determine the change in Black's deferred tax liabilities for the current year.

Definitions:

Sensorimotor Stage

The first stage in Piaget's theory of cognitive development, where infants learn about the world through their senses and motor activities.

Cognitive Accomplishment

A significant achievement or milestone in the development of cognitive abilities, such as problem-solving, memory, or understanding complex concepts.

Jean Piaget

A Swiss psychologist known for his pioneering work in child development and his theory of cognitive development stages.

Weakness

A lack of physical strength, or the state of being less strong or powerful in a physical or emotional sense.

Q1: In capital rationing, an initial screening of

Q23: The manager of a cost center has

Q24: Bryden Corporation is considering two tax planning

Q49: Which statement is not true with respect

Q59: The tax concept and economic concept of

Q74: There are 11 geographic U.S.Circuit Court of

Q83: Zync Inc.had $1,150,000 in invested assets, sales

Q100: Briefly discuss the two tests that an

Q160: MACRS does not use salvage value.As a

Q197: Janet is the CEO for Silver, Inc.,