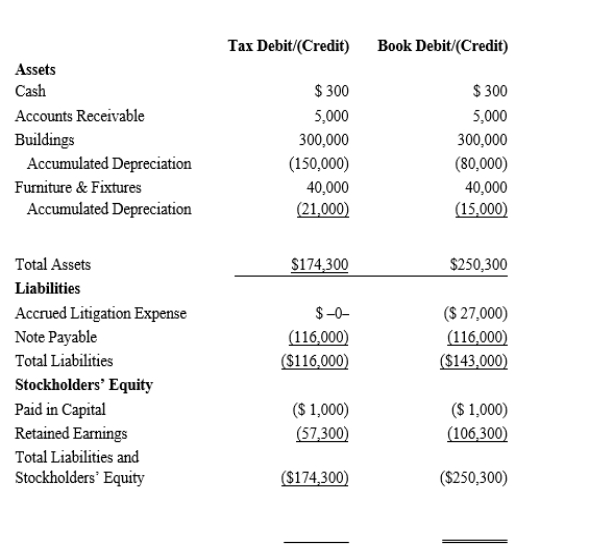

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 21% corporate tax rate and no valuation allowance.  Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.

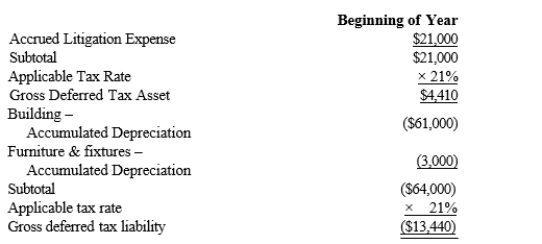

Black, Inc.'s, gross deferred tax assets and liabilities at the beginning of Black's year are listed below.  Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible business meals expense.Provide the income tax footnote rate reconciliation for Black, using either

dollars or percentages.

Definitions:

Network

A network refers to a group or system of interconnected people or things, often used in the context of social contacts or support systems.

Negotiator

A person who engages in discussion with one or more parties to reach an agreement or resolve a dispute.

Power

The ability or capacity to influence or control the behavior of others, often through the possession of certain resources or attributes.

Network Structure

The arrangement of and relationships between different nodes (individuals, organizations, etc.) within a network, determining how information or resources flow.

Q8: Gray Company, a closely held C corporation,

Q38: In general, present value methods of analyzing

Q53: Which of these is not a correct

Q58: In capital rationing, alternative proposals are initially

Q63: Julius, a married taxpayer, makes gifts to

Q81: Subchapter D refers to the "Corporate Distributions

Q92: Max opened his dental practice a sole

Q93: Sandra owns an insurance agency.The following selected

Q113: In 2018, Emily invests $120,000 in a

Q193: If an automobile is placed in service