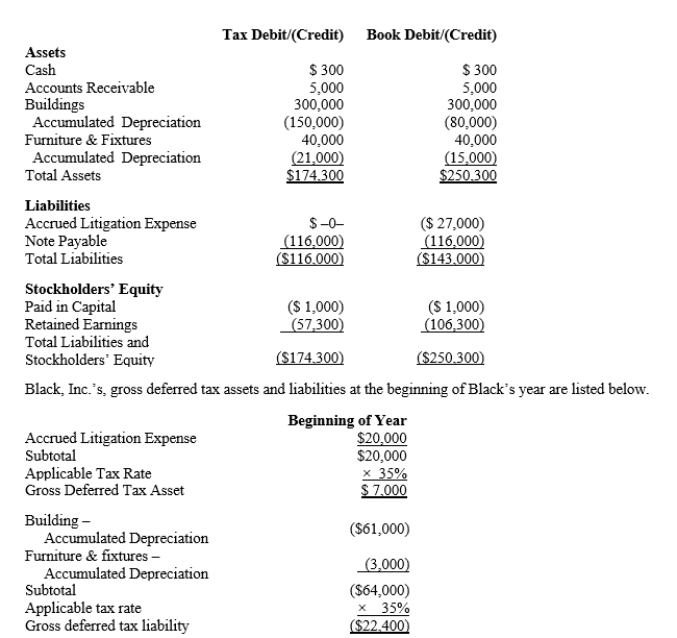

Black, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 35% corporate tax rate and no valuation allowance.  ?

?

Black, Inc.'s, book income before tax is $6,000.Black records two permanent book-tax differences.

It earned $250 in tax-exempt municipal bond interest, and it incurred $500 in nondeductible meals

and entertainment expense.Determine Black's change in net deferred tax asset or net deferred tax

liability for the current year, and provide the journal entry to record this amount.

Definitions:

Occupation

A person's job or profession, often defining a large part of their identity and socioeconomic status.

Survey Data

Information collected from a sample of individuals through their responses to questions, used in research to infer about a larger population.

Whorf

Refers to Benjamin Lee Whorf, an American linguist known for his hypotheses about the relation between language, thought, and cultural perception.

Inuit Language

A group of languages spoken by the Inuit people across the arctic regions of Canada, Greenland, and Alaska.

Q11: A materials quantity variance is calculated as

Q18: Maroon Corporation expects the employees' income tax

Q51: Ahmad owns four activities.He participated for 120

Q54: Mona inherits her mother's personal residence, which

Q70: Which of the following items are not

Q83: Jim acquires a new seven-year class asset

Q99: Bryden Corporation is considering two tax planning

Q143: The basis of an asset on which

Q162: Rex, a cash basis calendar year

Q164: Which of the following statements best describes