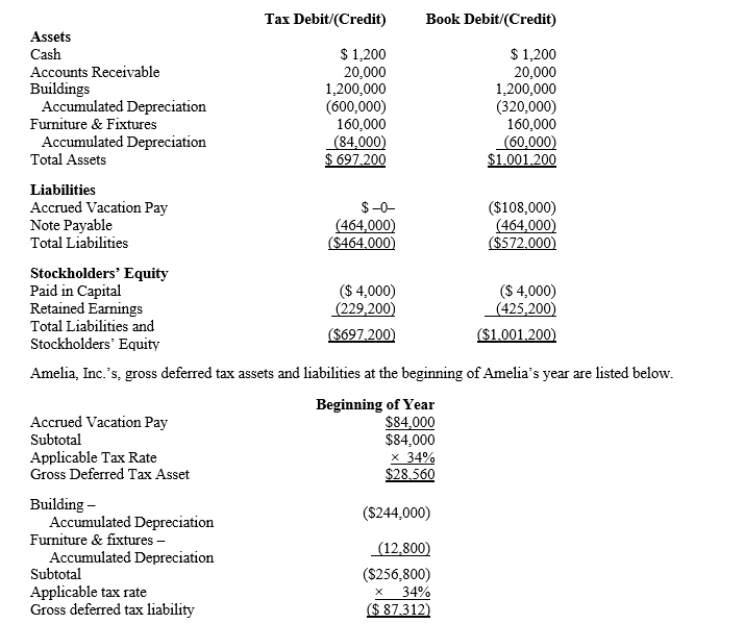

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.  Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense.Determine Amelia's change in net deferred tax asset or net deferred tax

liability for the current year, and provide the journal entry to record this amount.

Definitions:

Majority Votes

A decision-making process where the option receiving more than half of the votes from a group is selected or approved.

Special Funds

Financial resources set aside for a specific purpose or project, often within a larger organization or government.

Task Groups

Groups formed with the specific purpose of completing a particular task or achieving a targeted outcome.

Individual Goals

Objectives or aims that a person aims to achieve on a personal level.

Q2: The investigation of a materials quantity variance

Q23: A taxpayer who sustains a casualty loss

Q58: The final decision for setting standard costs

Q60: The difference between a budget and a

Q70: Doris Co.is considering purchasing a new machine

Q72: Black, Inc., is a domestic corporation

Q99: Sandra owns an insurance agency.The following

Q110: Bridgeware Company's materials price variance is<br>A)$400 U.<br>B)$400

Q113: An unfavourable labour quantity variance indicates that

Q152: South, Inc., earns book net income before