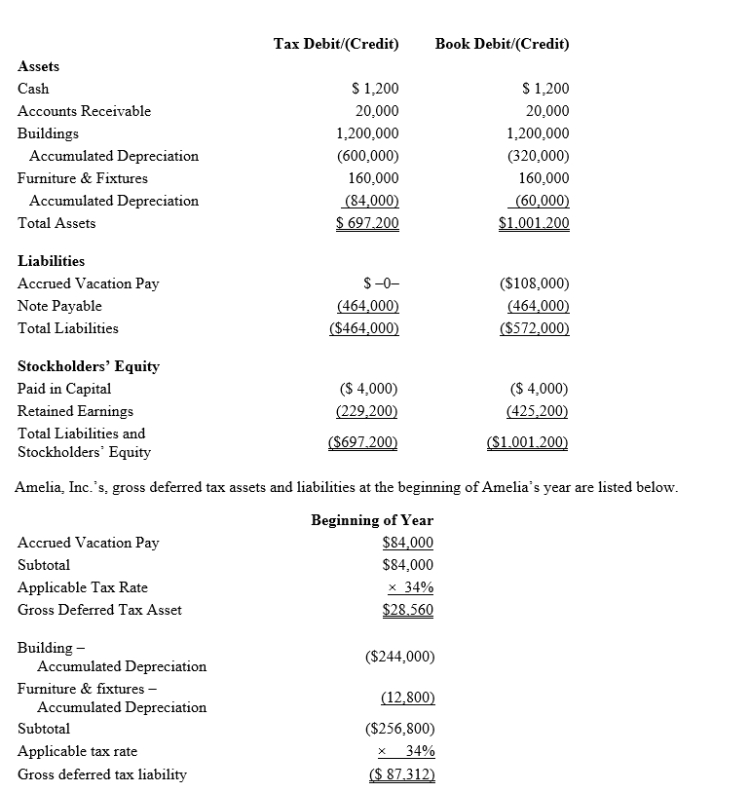

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.  Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.

It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and

entertainment expense.Calculate Amelia's current tax expense.

Definitions:

Looking-Glass Self

The self derived from seeing ourselves as others see us.

Psychodynamic Self

A concept in psychology that encompasses the dynamic, internal processes, motivations, and conflicts within the individual as influenced by unconscious factors.

Self-Affirmation

is the practice of reminding oneself of personal values and strengths in order to maintain a positive self-image and cope with threats to one's self-concept.

Achievement Motivation

The drive or desire for success and accomplishment, often pushing individuals to attain higher levels of performance.

Q11: A materials quantity variance is calculated as

Q18: If a company's required rate of return

Q34: A post-audit should be performed using<br>A)a different

Q49: Tax planning usually involves a completed transaction.

Q77: The direct materials quantity standard would not

Q99: Under the formula for taxing Social Security

Q100: Ned, a college professor, owns a separate

Q118: On June 1 of the current year,

Q131: The cost recovery period for 3-year class

Q137: Oriole Corporation has active income of $45,000