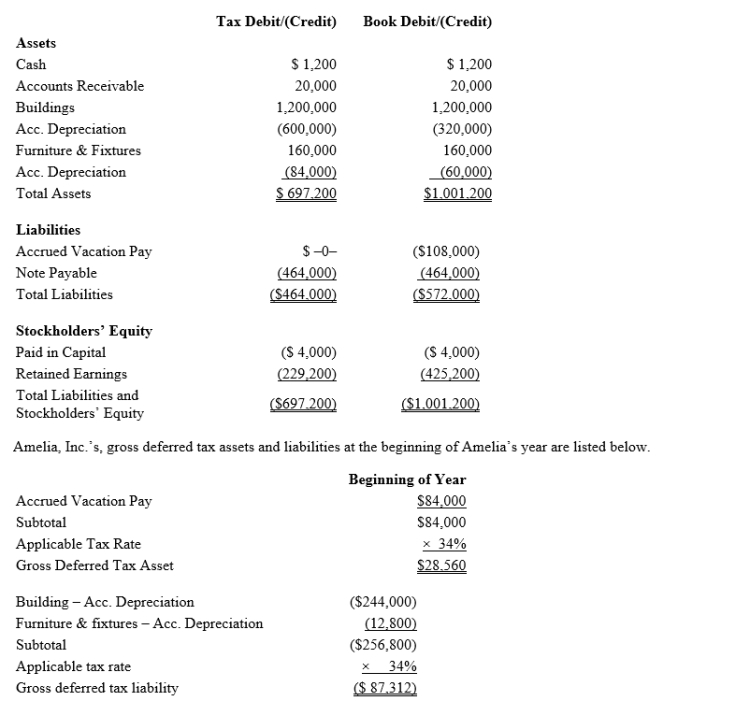

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.  Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine the change in Amelia's deferred tax liabilities for the current year.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine the change in Amelia's deferred tax liabilities for the current year.

Definitions:

Vocal Emphasis

The use of stress, tone, and pitch in speech to highlight or draw attention to specific words or phrases.

Webinar

is a seminar conducted over the internet that allows for interactive participation through the sharing of presentations, videos, and discussions.

User-Friendly Technology

Technology that is easy to use and understand, enhancing the user’s experience.

Target Audience

A specific group of people identified as the intended recipient of a product, service, or message, characterized by demographics or behaviors.

Q9: Post-audits of capital projects<br>A)are usually foolproof.<br>B)are done

Q16: Jed spends 32 hours a week, 50

Q33: Jon owns an apartment building in which

Q46: The U.S.Tax Court meets most often in

Q77: A taxpayer must pay any tax deficiency

Q77: The income tax footnote to the GAAP

Q84: Nextel Communications uses management by exception.Which differences

Q91: Morgan inherits her father's personal residence including

Q106: Which one of the following is true

Q143: The basis of an asset on which