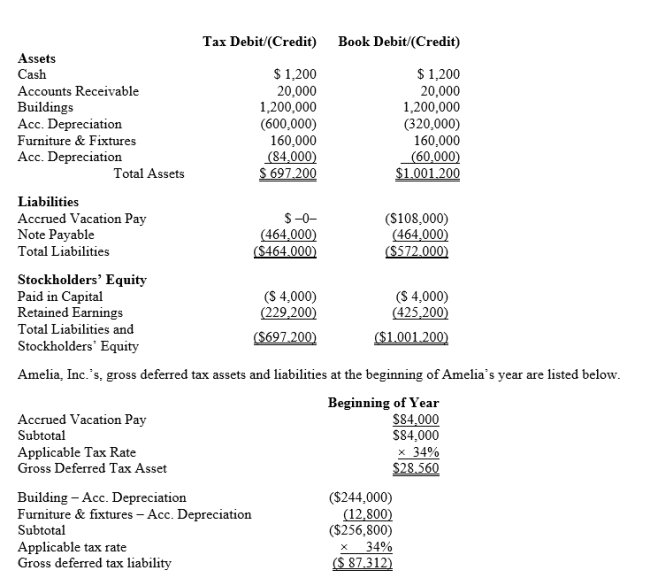

Amelia, Inc., is a domestic corporation with the following balance sheet for book and tax purposes at the end of the year.Assume a 34% corporate tax rate and no valuation allowance.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine the net deferred tax asset or net deferred tax liability at year end.

Amelia, Inc.'s, book income before tax is $25,200.Amelia records two permanent book-tax differences.It earned $1,000 in tax-exempt municipal bond interest and $1,840 in nondeductible meals and entertainment expense.Determine the net deferred tax asset or net deferred tax liability at year end.

Definitions:

Joseph McCarthy

An American senator known for his 1950s campaigns to expose supposed communist infiltration in the U.S. government, leading to a period of widespread paranoia known as McCarthyism.

George Marshall

An American military leader, statesman, and diplomat who served as the Chief of Staff of the U.S. Army during World War II and later as Secretary of State, where he advocated for the European Recovery Program (also known as the Marshall Plan).

Communist

Pertaining to a political and economic ideology aiming for a classless society with collective ownership of production means, where goods and services are distributed based on need.

Suburban Development

The process and growth of developing residential, commercial, and sometimes industrial areas on the outskirts of cities.

Q6: In 2017, Marci is considering starting

Q29: Jogg, Inc., earns book net income before

Q45: The factor for determining the cost recovery

Q51: After applying the balance sheet method

Q56: A company purchases 130,000 kilograms of materials.The

Q60: The difference between a budget and a

Q67: How can Congressional Committee Reports be used

Q74: Which of the following is a true

Q81: Blue Fin Co.produces a product requiring 10

Q149: How are deferred tax liabilities and assets