Use the following information for items

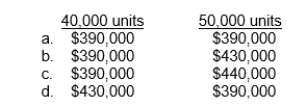

The Colin Division of Mochrie Company sells its product for $30 per unit.Variable costs per unit are: manufacturing, $12; and selling and administrative, $2.Fixed costs are: $200,000 manufacturing overhead, and $50,000 selling and administrative.There was no beginning inventory.Expected sales for next year are 40,000 units.Ryan Stiles, the manager of the Colin Division, is under pressure to improve the performance of the Division.As he plans for next year, he has to decide whether to produce 40,000 units or 50,000 units.

-What would the net income be under variable costing for each alternative?

Definitions:

Periodic Inventory System

A method of inventory valuation where the ending inventory and cost of goods sold are determined at the end of an accounting period.

Freight-In

Costs associated with transporting goods into a warehouse or to the buyer, typically included in the inventory cost under the accounting principle of absorption costing.

Inventory Account

An account that tracks the value of a company's inventory, including raw materials, work-in-process, and finished goods.

Perpetual Inventory System

An accounting method where inventory records are updated continuously as transactions occur.

Q4: A product requires processing in two departments,

Q6: Which one of the following helps improve

Q10: The per unit manufacturing cost under variable

Q12: A company incurs $1,200,000 of overhead each

Q16: A budget facilitates coordination of activities within

Q49: If production exceeds normal capacity, the overhead

Q50: Plant management is a batch-level activity.

Q54: Companies that use just-in-time processing techniques will

Q84: What is the process of evaluating financial

Q123: The production budget shows that expected unit