Use the following information for questions

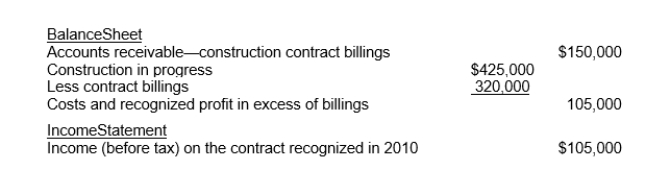

In 2010, Rupp Corporation began construction work under a three-year contract.The contract price is $3,500,000.Rupp uses the percentage-of-completion method for financial accounting purposes.The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract.The financial statement presentations relating to this contract at December 31, 2010, follow:

-What was the initial estimated total income before tax on this contract?

Definitions:

Q2: Which of the following is a required

Q5: On the December 31, 2010 balance sheet

Q23: The criteria for recognition of revenue at

Q27: Assuming that the errors made in 2010

Q30: Larsen Corp.issued a note with a face

Q37: Where would you expect to find depreciation

Q47: On June 1, 2010, Mays Corp.loaned Farr

Q49: The accounts receivable turnover ratio is calculated

Q53: The theory of constraints is used to

Q56: One of the advantages of a just