Use the following information for questions

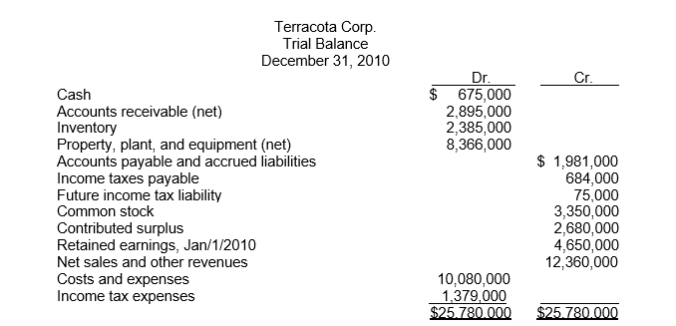

The following trial balance of Terracota Corp.at December 31, 2010 has been properly adjusted except for the income tax expense adjustment.

Other financial data for the year ended December 31, 2010:

Included in accounts receivable is $720,000 due from a customer and payable in quarterly instalments of $90,000.The last payment is due December 29, 2012.

The balance in the Future Income Tax Liability account pertains to a temporary difference that arose in a prior year, of which $30,000 is classified as a current liability.

During the year, estimated tax payments of $465,000 were charged to income tax expense.

The current and future tax rate on all types of income is 35 percent.In Terracota's December 31, 2010 balance sheet,

-The current assets total is

Definitions:

Factory Overhead

Costs associated with the manufacturing process that are not directly tied to the product being manufactured, such as utilities, maintenance, and managerial salaries.

Direct Labor Costs

Expenses associated with employees who directly contribute to the production of goods or services, such as wages and salaries for manufacturing workers.

Sustainable Business Activity

An approach to conducting business that prioritizes environmental conservation, social responsibility, and economic performance.

Crop Rotation

An agricultural technique where different types of crops are planted in the same area in sequenced seasons to improve soil health and reduce pest and disease risk.

Q5: Which of the following does not correctly

Q29: The widely publicized subprime lending crisis was

Q35: The actions a company takes to add

Q40: During 2010, Kurz Company purchased the net

Q45: The Ontario Securities Commission introduced regulations governing

Q46: Wriglee, Ltd.went to court this year and

Q57: For a nonmonetary exchange of plant assets,

Q62: Perkola, a public Corporation, owns the following

Q100: Determining the unit cost of manufacturing a

Q144: If the average collection period is 45