Use the following information for questions

Jeremiah Inc.is being targeted for acquisition by Argo Corporation.As an analyst for

Argo, you are asked to determine the goodwill that, pending various assumptions, may be inherent in this potential transaction.

The available information relating to Jeremiah includes the following: Current net assets: $5.1 million.

Expected return on net asset for industry: 10%

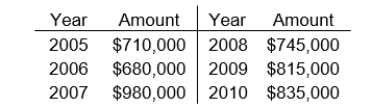

Reported net income for the previous six consecutive years:

The earnings for 2007 included a $200,000 gain from the sale of a discontinued part of its business.

-Estimated goodwill by capitalizing average excess earnings at 14% is

Definitions:

Prophesized

Predicted or foretold a future event, especially one that is divinely inspired and relates to human or world events in a significant way.

Invasion of Russia

Often refers to the unsuccessful military campaign by Napoleon Bonaparte's Grande Armée against Russia in 1812.

Generals

High-ranking military officers who command large units or perform administrative duties in an army.

Large Army

A significantly sized military force, typically referring to the land-based military branch of a nation, capable of conducting major operations and engaging in warfare.

Q11: Which of the following describes one of

Q18: A company's balance sheet<br>A)Would never include accumulated

Q23: In preparing its May 31, 2010 bank

Q26: The category that is generally considered to

Q29: Charging off the cost of a wastebasket

Q37: Using vertical analysis on the income statement,

Q64: Repurchase of Ingles' own common shares on

Q69: When the conventional retail inventory method is

Q71: Under the equity method, the receipt of

Q132: The inventory turnover ratio is calculated by