SCENARIO 5-7 There Are Two Houses with Almost Identical Characteristics Available for Available

SCENARIO 5-7

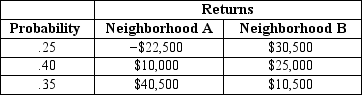

There are two houses with almost identical characteristics available for investment in two different neighborhoods with drastically different demographic composition.The anticipated gain in value when the houses are sold in 10 years has the following probability distribution:

-Referring to Scenario 5-7,if your investment preference is to minimize the amount of risk that you must take and do not care at all about the expected return,will you choose a portfolio that will consist of 10%,30%,50%,70%,or 90% of your money on the house in neighborhood A and the remaining on the house in neighborhood B?

Definitions:

Financial Risks

The potential for losses due to fluctuations in financial markets, interest rates, foreign exchange rates, and credit risk.

Computer Software

Programs and other operating information used by a computer to perform specific tasks.

Globalization

The process of interaction and integration among people, companies, and governments worldwide, influenced by trade, investment, and technology.

Risk Profile

An evaluation of an individual's or organization's willingness and capacity to take risks, as well as the potential loss that could result from those risks.

Q36: Referring to Scenario 7-5,the population mean of

Q93: In a game called Taxation and Evasion,a

Q105: Which of the following is NOT a

Q111: Referring to Scenario 4-5,if a package selected

Q118: Referring to Scenario 3-2,the interquartile range in

Q122: The Central Limit Theorem is considered powerful

Q150: Given below is the scatter plot of

Q152: Referring to Scenario 5-1,the probability that at

Q161: Referring to Scenario 4-3,assume we know that

Q175: Referring to Scenario 6-3,what is the probability