SCENARIO 14-17

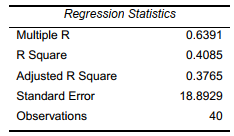

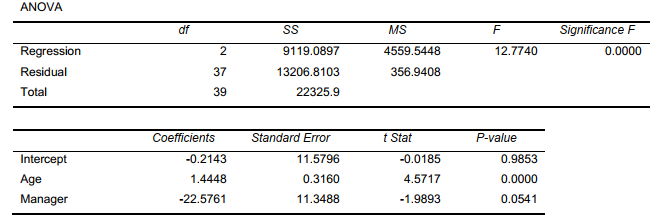

Given below are results from the regression analysis where the dependent variable is the number of weeks a worker is unemployed due to a layoff (Unemploy)and the independent variables are the age of the worker (Age)and a dummy variable for management position (Manager: 1 = yes,0 = no).

The results of the regression analysis are given below:

-Referring to Scenario 14-17,the null hypothesis

H0: 1= 2=0implies that the number of

weeks a worker is unemployed due to a layoff is not affected by some of the explanatory variables.

Definitions:

Financing Activity

Transactions involving the flow of cash between a company and its owners and creditors, including issuing stocks, paying dividends, and borrowing or repaying loans.

Transactions

The financial events that affect the assets, liabilities, and equity of an entity, involving transfers or exchanges between two parties.

Cash Flows

The net amount of cash being transferred into and out of a business.

Q1: Referring to Scenario 15-5,what is the value

Q33: The Chancellor of a university has commissioned

Q40: Neural networks can suffer from poor quality

Q58: Treemaps that use color to represent the

Q73: Referring to Scenario 17-4,the highest mean weekend

Q95: To explain personal consumption (CONS)measured in dollars,data

Q107: A quality control engineer is in

Q114: Testing for the existence of correlation

Q131: Referring to Scenario 16-2,advertising expenditures appear to

Q177: A contractor wants to forecast the number