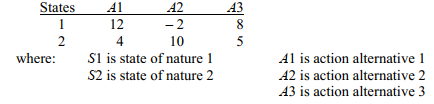

SCENARIO 20-1

The following payoff table shows profits associated with a set of 3 alternatives under 2 possible states of nature.

-Referring to Scenario 20-1,if the probability of S1 is 0.2 and S2 is 0.8,then the expected monetary value of A1 is

Definitions:

Current Assets

Assets that are expected to be converted into cash, sold, or consumed within one year or the operating cycle, whichever is longer.

Net Income

Refers to the total earnings or profit of a company after subtracting all expenses from its total revenue.

Total Debts

The sum of all financial obligations a company owes to outside parties, including both short-term and long-term liabilities.

Current Liabilities

Short-term financial obligations that a company is required to pay within a year.

Q11: Referring to Scenario 12-21,what is the right

Q12: Noncash investing and financing activities must be

Q21: Referring to Scenario 18-1,which of the following

Q22: The current ratio is<br>A)calculated by dividing current

Q48: Referring to Scenario 18-5,the total degrees of

Q53: Common causes of variation are correctable without

Q58: Referring to Scenario 19-9,based on the x̄

Q137: Referring to Scenario 8-16,if the population had

Q194: Referring to Scenario 18-3,the value of the

Q230: Referring to Scenario 18-11,what should be the