SCENARIO 20-1

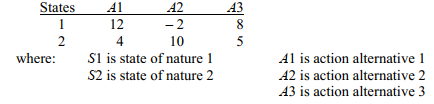

The following payoff table shows profits associated with a set of 3 alternatives under 2 possible states of nature.

-Referring to Scenario 20-1,if the probability of S1 is 0.5,then the expected opportunity loss (EOL) for A3 is

Definitions:

Interest Expense

The cost incurred by an entity for borrowed funds; interest expense is often deductible for the borrower for tax purposes.

Inflation

The rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling.

Stockholders' Equity/Total Assets

A ratio expressing the proportion of a company's assets that are financed by shareholders' equity.

Long-Term Debt/Stockholders' Equity

A financial ratio that measures a company's leverage by comparing its long-term debt to its stockholders' equity.

Q23: Referring to Scenario 7-8,the mean of all

Q55: The R chart is a control chart

Q57: Referring to Scenario 8-14,using the 90% one-sided

Q77: When using the normal approximation to the

Q105: Referring to Scenario 18-9,what is the correct

Q133: Referring to Scenario 18-8,the null hypothesis

Q141: SMED establishes ways to eliminate unnecessary housekeeping

Q164: Referring to Scenario 18-4,what is the value

Q226: Referring to Scenario 8-17,if he wants a

Q256: Data were collected on the amount of