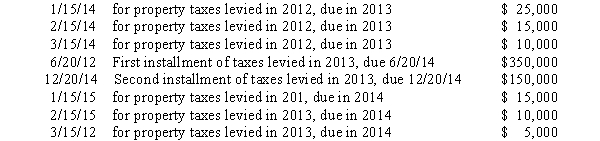

A city that has a 12/31 fiscal year end has adopted a policy of recognizing property tax revenue consistent with the 60-day rule allowable period under GAAP.Property taxes of $600,000 (of which none are estimated to be uncollectible) are levied in October 2013 to finance the activities of fiscal year 2014.Property taxes are due in two installments June 20 and December 20.Cash collections related to property taxes are as follows:  The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2014 is:

The total amount of property tax revenue that will be recognized in the government-wide financial statements in 2014 is:

Definitions:

Customers

Individuals or organizations that purchase goods or services from a business, determining its success through their satisfaction and loyalty.

Technology

The application of scientific knowledge for practical purposes, particularly in industry and everyday life.

Account Control

The process of managing and overseeing a customer account to ensure satisfaction, retention, and profitability.

Q4: Which of the following is not includible

Q5: This year, Port City was sued for

Q8: In the capital projects fund<br>A)Debit Cash $50,000;

Q9: An excellent source of funds with which

Q10: In the following citation, Eugene Coloman, 33

Q11: A government's financial condition<br>A)Is another term for

Q17: Which of the following statements concerning the

Q23: The most significant financial document provided by

Q28: Reserve for encumbrances accounts should be closed

Q54: Special assessments are imposed nonexchange transactions, similar