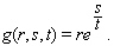

Let  Compute the following. g(1, 1, 1) , g(- 1, 0, 1) , g(- 1, 1, 1)

Compute the following. g(1, 1, 1) , g(- 1, 0, 1) , g(- 1, 1, 1)

Definitions:

Marginal Tax Rate

The rate at which the last dollar of income is taxed, indicating the rate of tax that applies to each additional dollar of income.

Marginal Tax Rate

The rate of tax applied to the next dollar of taxable income, which increases in brackets as income rises.

Proportional Income Tax

A tax system where the rate of taxation is the same for all taxpayers, regardless of income level.

Q2: If a transportation problem has four origins

Q20: The shortest-route problem is a special case

Q25: In an all-integer linear program,<br>A)all objective function

Q45: Find the critical point(s) of the function.Then

Q84: Find the area of the region under

Q140: Evaluate the given definite integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7866/.jpg"

Q179: Suppose a tractor purchased at a price

Q204: Find the equation of the least-squares line

Q215: Find the indefinite integral. <img src="https://d2lvgg3v3hfg70.cloudfront.net/TB7866/.jpg" alt="Find

Q254: The demand function for a certain brand