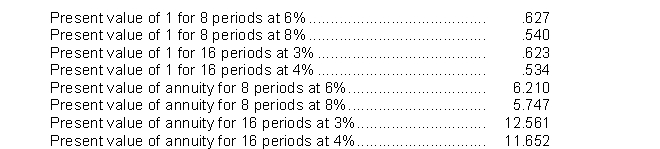

Use the following information for questions.issued eight-year bonds with a face value of $1,000,000 and a stated interest rate of 6%, payable semiannually on June 30 and December 31.The bonds were sold to yield 8%.Table values are:

-Farmer Company issues $10,000,000 of 10-year, 9% bonds on March 1, 2010 at 97 plus accrued interest.The bonds are dated January 1, 2010, and pay interest on June 30 and December 31.What is the total cash received on the issue date?

Definitions:

Costs Per Unit

The expenses involved in producing a single unit of a product, including materials, labor, and overhead.

Total Cost Function

A mathematical representation of the total expenses involved in production, including both fixed and variable costs, as a function of output level.

Input Prices

The costs associated with the purchase of the factors of production, including wages for labor, prices for raw materials, and capital costs.

Average Variable Cost

Average variable cost is the total variable cost divided by the quantity of output produced, showing the cost of producing each unit excluding fixed costs.

Q4: Factors considered in determining an intangible asset's

Q26: The expected profit from a sales type

Q33: Consider a two-country, two-commodity model. The

Q34: The IASB's position is that fair value

Q56: The asset turnover ratio is computed by

Q73: The cost of acquiring a customer list

Q76: If an industrial firm uses the units-of-production

Q79: An impairment loss is the amount by

Q80: Istandul Enterprise constructed a building at a

Q125: Which of the following may be a