Use the following information for questions.

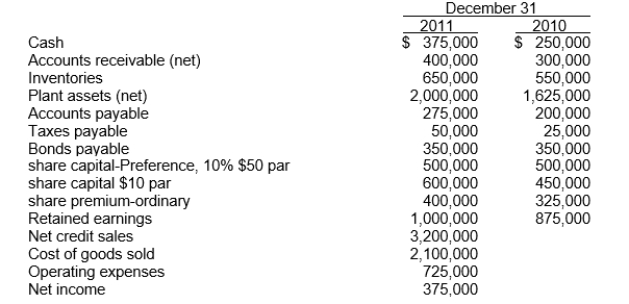

The following data are provided:

Additional information:

Depreciation included in cost of goods sold and operating expenses is $305,000.On May 1, 2011, 15,000 ordinary shares were issued.The preference share are cumulative.The preference dividends were not declared during 2011.

-The receivables turnover for 2011 is

Definitions:

Sales Taxes

Taxes imposed by governments on sales of goods and services, typically calculated as a percentage of the retail price paid by the consumer.

Perpetual Systems

Inventory management systems that continuously update the quantity and value of inventory stock, allowing for real-time tracking.

Inventory Units

Measurements denoting the quantity of goods that a company has on hand at any given time.

Inventory Holding Gain

An increase in the value of inventory over time, typically due to inflation or increased demand, before the inventory is sold.

Q6: The underlying theme of the conceptual framework

Q15: The historical cost principle would be of

Q32: The total effect of the errors on

Q33: From the lessor's viewpoint, what type of

Q33: The IASB requires allocations of joint, common,

Q33: If a company prepares a consolidated income

Q45: Deductible amounts cause taxable income to be

Q89: Companies report any actuarial gains or losses

Q89: An adjusting entry should never include<br>A)a debit

Q98: If companies want to disqualify a lease