Use the following information for questions.

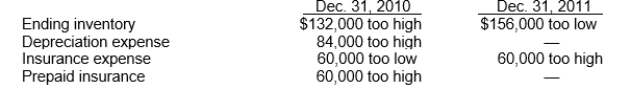

Bishop Co.began operations on January 1, 2010.Financial statements for 2010 and 2011 con- tained the following errors:

In addition, on December 31, 2011 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2012.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on the amount of Bishop's working capital at December 31, 2011 is understated by

Definitions:

Identity Phase

A stage of development where individuals explore, question, and begin to solidify their personal identity and values.

Self-direction

The capability or act of managing and guiding one's own activities and progress, often towards personal goals.

Alternative Possibilities

In philosophy, the concept that for an action to be considered free, the individual must have been able to act otherwise in any given situation.

Marital Satisfaction

The degree of contentment and fulfillment an individual feels in their marriage, often used as a measure of the health and success of the relationship.

Q16: An accrued revenue can best be described

Q39: What is a major objective of financial

Q51: Companies compute the vested benefit obligation using

Q55: As part of the objective of general-purpose

Q65: Ferguson Company has the following cumulative taxable

Q67: The Financial Accounting Standards Board<br>A)has issued a

Q70: Judd, Inc., owns 35% of Cosby Corporation.During

Q77: The relationship between the amount funded and

Q83: Under the loss carryback approach, companies must

Q92: According to the IASB, recognition of a