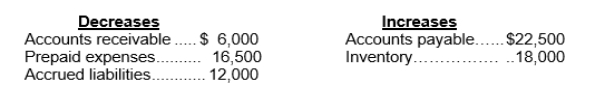

During 2011, Greta Company earned net income of $192,000 which included depreciation expense of $39,000.In addition, the Company experienced the following changes in the account balances listed below:

Based upon this information what amount will be shown for net cash provided by operating activities for 2011.

Definitions:

Social Changes

The significant alterations over time in behavior patterns, cultural norms, and societal structures.

Precedent

A legal decision or form of proceeding serving as an authoritative rule or pattern in future similar or analogous cases.

Precedent

An earlier event or action that is regarded as an example or guide to be considered in subsequent similar circumstances.

Subsequent Cases

Legal cases that follow prior ones, potentially influenced by earlier judgments or rulings.

Q2: At December 31, 2011, Eilert would report

Q7: A trial balance may prove that debits

Q19: Depreciation expense for 2011 was<br>A)$258,000.<br>B)$234,000.<br>C)$54,000.<br>D)$36,000.

Q20: What is the amount of the deferred

Q45: Deductible amounts cause taxable income to be

Q54: The failure to properly record an adjusting

Q54: All of the following statement are true

Q62: Zephyr plc amends its defined pension plan

Q66: Which of the following is not treated

Q104: All of the followings are ways in