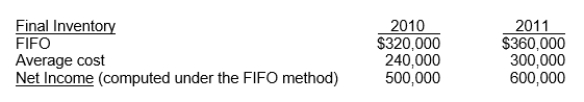

Lanier Company began operations on January 1, 2010, and uses the FIFO method in costing its raw material inventory.Management is contemplating a change to the average cost method and is interested in determining what effect such a change will have on net income.Accordingly, the following information has been developed:

Based upon the above information, a change to the average cost method in 2011 would result in net income for 2011 of

Definitions:

Sales Forecast

An estimate of the amount of revenue that a company expects to generate from the sale of goods or services in a future period.

Planning Horizon

The future time period over which plans and strategies are developed and analyzed.

Direct Materials Budget

A financial plan that estimates the raw materials required for production and the expected costs.

Quantity Purchased

The total amount of a product that a consumer or company acquires.

Q6: Pye Company leased equipment to the Polan

Q7: Companies should recognize revenue when it is

Q15: Delayed recognition of revenue is appropriate if

Q37: On December 1, 2011, Goetz Corporation leased

Q43: When the equipment was sold, the Buildings

Q61: How much cash was collected in 2012

Q73: Companies should report accounting transactions as they

Q83: In 2012, Sauder should record interest expense

Q86: Which of the following is not considered

Q123: When is revenue generally recognized?<br>A)When cash is