Use the following information for questions.

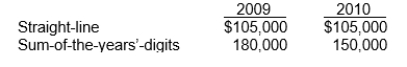

Ventura Corporation purchased machinery on January 1, 2009 for $630,000.The company used the sum-of-the-years'-digits method and no salvage value to depreciate the asset for the first two years of its estimated six-year life.In 2010, Ventura changed to the straight-line depreciation method for this asset.The following facts pertain:

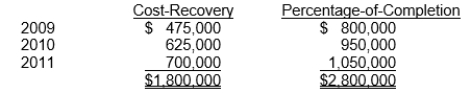

-During 2011, a construction company changed from the cost-recovery method to the percentage-of-completion method for accounting purposes but not for tax purposes.Gross profit figures under both methods for the past three years appear below:

Assuming an income tax rate of 40% for all years, the affect of this accounting change on prior periods should be reported by a credit of

Definitions:

Exceptions

Specific conditions or cases for which the general rule does not apply.

Firm Offers

In contract law, promises made by a seller to hold an offer open to a buyer for a certain period without requiring consideration.

Irrevocable Offers

Offers in a contractual context that cannot be withdrawn, revoked, or altered once made, often for a specific period of time.

Consideration

In contract law, something of value (such as goods, services, or money) exchanged between parties that is necessary for a valid contract.

Q3: Recognition of tax benefits in the loss

Q6: The net cash provided (used) by investing

Q8: Revenues are realizable when assets received or

Q18: Duncan Inc.uses the accrual method of accounting

Q35: Lark Corp.has a contract to construct a

Q44: Wynn, Inc.has a contract to construct a

Q62: The revenue recognition principle indicates that revenue

Q70: In 2011, Sauder should record interest expense

Q81: Assuming that Sands, Inc.uses straight-line depreciation, what

Q91: The amount of the cash dividend was<br>A)$248,000.<br>B)$328,000.<br>C)$442,000.<br>D)$638,000.