Use the following information for questions.

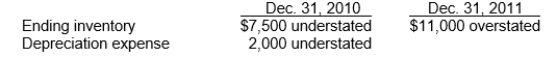

Langley Company's December 31 year-end financial statements contained the following errors:

An insurance premium of $18,000 was prepaid in 2010 covering the years 2010, 2011, and 2012.The prepayment was recorded with a debit to insurance expense.In addition, on December 31, 2011, fully depreciated machinery was sold for $9,500 cash, but the sale was not recorded until 2012.There were no other errors during 2011 or 2012 and no corrections have been made for any of the errors.Ignore income tax considerations.

-What is the total net effect of the errors on Langley's 2011 net income?

Definitions:

Rent

The payment made by a tenant to a landlord for the use of a property, room, or apartment for a specified period.

Depreciation

Accounting method of allocating the cost of a tangible or physical asset over its useful life, reflecting wear and use over time.

Indirect Business Taxes

Taxes levied on goods and services rather than on income or profits, such as sales tax or value-added tax, ultimately passed on to consumers in the form of higher prices.

National Income

The total amount of money earned within a country, including wages, rent, interest, and profits.

Q23: Deferred taxes should be presented on the

Q35: Which of the following has the highest

Q38: Mayo Corp.has estimated that total depreciation expense

Q40: Which of the following is an ingredient

Q49: Eckert Corporation's partial income statement after its

Q50: For counterbalancing errors, restatement of comparative financial

Q55: An investment of more than 50 percent

Q67: On July 1, 2012, Carsen Company should

Q70: An alternative not available when the seller

Q110: Share capital stock (plus any share premium)