Use the following information for questions.

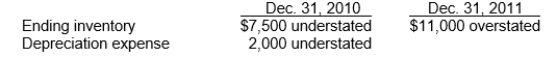

Langley Company's December 31 year-end financial statements contained the following errors:

An insurance premium of $18,000 was prepaid in 2010 covering the years 2010, 2011, and 2012.The prepayment was recorded with a debit to insurance expense.In addition, on December 31, 2011, fully depreciated machinery was sold for $9,500 cash, but the sale was not recorded until 2012.There were no other errors during 2011 or 2012 and no corrections have been made for any of the errors.Ignore income tax considerations.

-Accrued salaries payable of $51,000 were not recorded at December 31, 2010.Office supplies on hand of $24,000 at December 31, 2011 were erroneously treated as expense instead of supplies inventory.Neither of these errors was discovered nor corrected.The effect of these two errors would cause

Definitions:

Lumbar Trunks

Large lymphatic vessels in the lumbar region of the body that drain lymph from the lower limbs, abdominal wall, and pelvic organs.

Subclavian Vein

A major vein on either side of the body that receives blood from the arm and the thorax, leading to the superior vena cava.

Cervical Lymph Nodes

Small, bean-shaped glands located in the neck region, part of the lymphatic system, involved in the body's immune response.

Phagocytized

The process by which cells, typically immune cells, engulf and digest foreign particles or pathogens, contributing to the body's defense mechanism.

Q12: If a company sells its product but

Q17: In order to provide information that is

Q25: Over 115 countries require or permit use

Q34: In the International Accounting Standards Board's (IASB's)

Q41: General-purpose financial statements are the product of<br>A)financial

Q43: When the equipment was sold, the Buildings

Q44: Wynn, Inc.has a contract to construct a

Q62: What is the amount of profit on

Q70: The ending balance in Elephant, Inc's deferred

Q73: Presented below is information related to Jensen