Use the following information for questions.

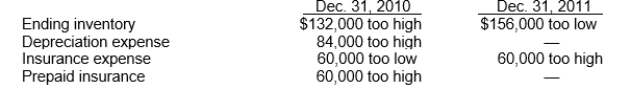

Bishop Co.began operations on January 1, 2010.Financial statements for 2010 and 2011 con- tained the following errors:

In addition, on December 31, 2011 fully depreciated equipment was sold for $28,800, but the sale was not recorded until 2012.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on Bishop's 2011 net income is

Definitions:

Return On Assets

A profitability ratio that measures how efficient a company is at using its assets to generate earnings, calculated as net income divided by total assets.

Times Interest Earned Ratio

A financial metric that measures a company's ability to cover its interest expenses with its earnings before interest and taxes (EBIT).

Income Tax Payments

Payments made to government entities based on earned income and profits, an obligation for individuals and businesses.

Interest Expense

The cost incurred by an entity for borrowing funds, typically reflected in the profit and loss statement.

Q6: The information provided by financial reporting pertains

Q11: If an employee fails to exercise a

Q12: Based on this information and rounding all

Q26: When share dividends or share splits occur,

Q35: Mays Company has a machine with a

Q51: Companies compute the vested benefit obligation using

Q79: Ethical issues in financial accounting are governed

Q82: On January 1, 2012 Dairy Treats, Inc.entered

Q84: What is the relationship between the Securities

Q101: Which basic assumption may not be followed