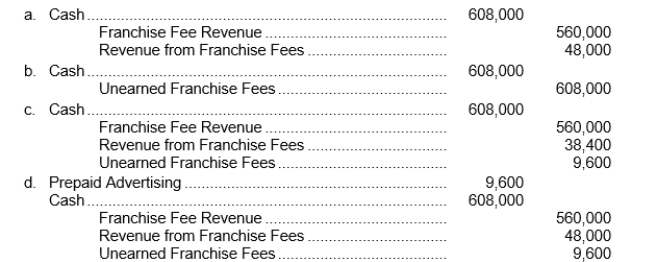

On January 1, 2012 Dairy Treats, Inc.entered into a franchise agreement with a company allowing the company to do business under Dairy Treats's name.Dairy Treats had performed substantially all required services by January 1, 2012, and the franchisee paid the initial franchise fee of $560,000 in full on that date.The franchise agreement specifies that the franchisee must pay a continuing franchise fee of $48,000 annually, of which 20% must be spent on advertising by Dairy Treats.What entry should Dairy Treats make on January 1, 2012 to record receipt of the initial franchise fee and the continuing franchise fee for 2012?

Definitions:

Q2: The following information is related to the

Q7: Companies should recognize revenue when it is

Q16: Based on this information and rounding all

Q43: In a sale-leaseback transaction where none of

Q54: The lessor will recover a greater net

Q56: On April 1, 2012 Weston, Inc.entered into

Q70: The ending balance in Elephant, Inc's deferred

Q80: Sosa Co.'s equity at January 1, 2012

Q87: Lehman Corporation purchased a machine on January

Q88: Watson Corporation prepared the following reconciliation for