Use the following information for questions.

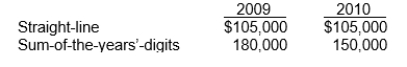

Ventura Corporation purchased machinery on January 1, 2009 for $630,000.The company used the sum-of-the-years'-digits method and no salvage value to depreciate the asset for the first two years of its estimated six-year life.In 2010, Ventura changed to the straight-line depreciation method for this asset.The following facts pertain:

-Ventura is subject to a 40% tax rate.The cumulative effect of this accounting change on beginning retained earnings is

Definitions:

Principle of Reciprocity

A social norm suggesting that a favor done for someone should be reciprocated by them in the future.

Pareto Principle

Also known as the 80/20 rule, it suggests that 80% of effects come from 20% of causes, applicable across various fields.

Equity Theory

A psychological theory which proposes that employees are motivated when they perceive their treatment in the workplace as fair, especially in how rewards are distributed.

Fairplay Rule

An ethical guideline ensuring fairness and honesty in transactions and interactions, often in sports or business.

Q2: From the lessee's viewpoint, an unguaranteed residual

Q8: Interpretations issued by IFRIC are more authoritative

Q10: Types of franchising arrangements include all of

Q16: An accrued revenue can best be described

Q31: Fraudulent financial reporting is intentional or reckless

Q43: When the equipment was sold, the Buildings

Q47: Companies must use the percentage-of-completion method when

Q50: Politics and political pressure in establishing IFRS

Q56: Companies should consider both positive and negative

Q73: The requirements for disclosure are the same