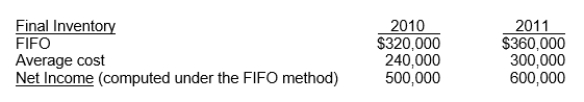

Lanier Company began operations on January 1, 2010, and uses the FIFO method in costing its raw material inventory.Management is contemplating a change to the average cost method and is interested in determining what effect such a change will have on net income.Accordingly, the following information has been developed:

Based upon the above information, a change to the average cost method in 2011 would result in net income for 2011 of

Definitions:

Patent

An exclusive right given to inventors to produce and sell a new product or machine for 20 years from the time of patent application.

Imitation

The action of using someone or something as a model and copying their behavior or actions.

Legal Expenses

Costs associated with legal advice, litigation, or other legal activities which individuals or businesses might incur.

Trademark

A recognizable sign, design, or expression that identifies products or services of a particular source from those of others, legally protected under intellectual property laws.

Q7: The body that has the power to

Q9: An adjusted trial balance<br>A)is prepared after the

Q19: Changing the method of inventory valuation should

Q37: What is the purpose of a FASB

Q50: At each reporting date, companies adjust debt

Q65: Ferguson Company has the following cumulative taxable

Q81: In the conceptual framework for financial reporting,

Q85: After the lessor establishes the payment, there

Q104: The basic assumptions of accounting used by

Q121: What is the quality of information that