Use the following information for questions.

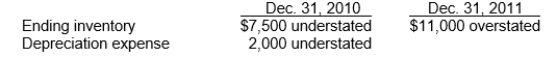

Langley Company's December 31 year-end financial statements contained the following errors:

An insurance premium of $18,000 was prepaid in 2010 covering the years 2010, 2011, and 2012.The prepayment was recorded with a debit to insurance expense.In addition, on December 31, 2011, fully depreciated machinery was sold for $9,500 cash, but the sale was not recorded until 2012.There were no other errors during 2011 or 2012 and no corrections have been made for any of the errors.Ignore income tax considerations.

-What is the total effect of the errors on the balance of Langley's retained earnings at December 31, 2011?

Definitions:

Buy-Side Marketplace

B2B model in which organizations buy needed products or services from other organizations electronically, often through a reverse auction.

Electronic Exchange

A platform or system that facilitates the trading of financial instruments, commodities, or other products through electronic systems without the need for physical trading floors.

Sell-Side Marketplace

B2B model in which organizations sell to other organizations from their own private e-marketplace or from a third-party site.

Cyber-Squatting

The practice of registering, selling, or using a domain name with the intent of profiting from the goodwill of a trademark belonging to someone else.

Q6: For share appreciation rights, the measurement date

Q8: IFRS requires that lessees use the incremental

Q10: The accounting profession requires disaggregated information in

Q42: For the year ended December 31, 2012,

Q46: The economic entity assumption means that economic

Q55: As part of the objective of general-purpose

Q65: The total effect of the errors on

Q66: In computing diluted earnings per share, share

Q88: Which of the following (a-c) are not

Q109: To be a faithful representation as described