Use the following information for questions.

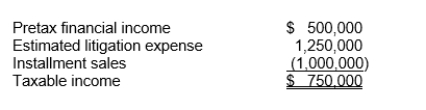

Mathis Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,250,000 will be deductible in 2012 when it is expected to be paid.The gross profit from the installment sales will be realized in the amount of $500,000 in each of the next two years.The estimated liability for litigation is classified as non-current and the installment accounts receivable are classified as $500,000 current and $500,000 noncurrent.The income tax rate is 30% for all years.

-The income tax expense is

Definitions:

Taxation

The process by which governments finance their expenditure by imposing charges on citizens and corporate entities.

Ping Ponging

The process in which legislative bills are sent back and forth between the two houses of a legislature for approval or amendment.

Divided Congress

A situation in which one party controls the U.S. House of Representatives and another party controls the U.S. Senate.

Conference Committees

are temporary committees formed to reconcile differences between the House and Senate versions of a bill before it is sent to the president for approval.

Q24: The receivables turnover for 2011 is<br>A)3,200 ÷

Q26: Long Co.issued 100,000 shares of $10 par

Q27: When a company sells property and then

Q31: On January 2, 2012, LexxMark Co.issues 2,000

Q55: Under the direct method, the total taxes

Q84: In computing the annual lease payments, the

Q85: What is the payout ratio for Layne

Q89: Presented below is the equity section of

Q93: What is the pension expense that Cooper

Q104: Janae Corporation has outstanding 10,000 shares of