Use the following information for questions.

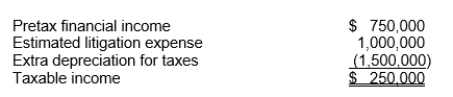

Hopkins Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

-Stephens Company has a deductible temporary difference of $2,000,000 at the end of its first year of operations.Its tax rate is 40 percent.Stephens has $1,800,000 of income taxes payable.After a careful review of all available evidence, Stephens determines that it is probable that it will not realize $200,000 of this deferred tax asset.On Stephens Company's statement of financial position at the end of its first year of operations, what is the amount of deferred tax asset?

Definitions:

Underapplied Overhead

A situation where the allocated overhead costs are less than the actual overhead costs incurred.

Cost of Goods Sold

The total cost directly associated with producing the goods that have been sold during a specific period.

Period End

The conclusion of an accounting period, at which time financial statements are prepared and financial activities are summarized.

Transfer

The movement of resources, products, or services from one part of an organization to another.

Q11: The methods of accounting for a lease

Q24: Companies classify the balances in the deferred

Q25: A reconciliation of Gentry Company's pretax accounting

Q28: A publicly accountable enterprise changes from straight-line

Q33: Transfers between categories<br>A)result in companies omitting recognition

Q37: On December 1, 2011, Goetz Corporation leased

Q68: What was the initial estimated total income

Q70: An alternative not available when the seller

Q102: The IASB encourages the use of the

Q103: The share dividend should be reported on