Use the following information for questions.

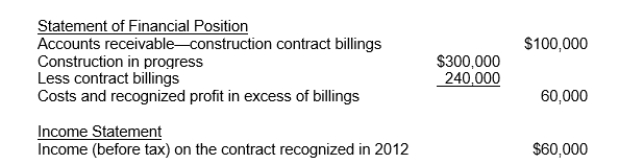

In 2012, Fargo Corporation began construction work under a three-year contract.The contract price is $2,400,000.Fargo uses the percentage-of-completion method for financial accounting purposes.The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract.The financial statement presentations relating to this contract at December 31, 2012, follow:

-What was the initial estimated total income before tax on this contract?

Definitions:

Pro Forma Statements

Financial statements prepared to show the effects of future events or transactions, typically used in projections.

Bottom-Up Approach

An investment analysis approach focusing on individual stocks or companies, as opposed to the broader market conditions or economic trends.

Operating Cash Flow

The total amount of cash generated by a company's normal business operations.

Noncash Deductions

Expenses that reduce a company's taxable income but do not involve an actual cash outflow, such as depreciation and amortization.

Q19: Which of the following is not a

Q20: Reasons for increased disclosure requirements do NOT

Q24: An executive pays no taxes at time

Q29: The total lease-related expenses recognized by the

Q34: For the year ended December 31, 2011,

Q43: Revenue should be measured at the fair

Q51: Companies compute the vested benefit obligation using

Q56: The net income for Akira Industries for

Q63: The net cash provided (used) by investing

Q99: The Unrecognized Net Gain or Loss account