Use the following information for questions.

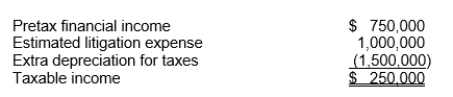

Hopkins Co.at the end of 2010, its first year of operations, prepared a reconciliation between pretax financial income and taxable income as follows:

The estimated litigation expense of $1,000,000 will be deductible in 2011 when it is expected to be paid.Use of the depreciable assets will result in taxable amounts of $500,000 in each of the next three years.The income tax rate is 30% for all years.

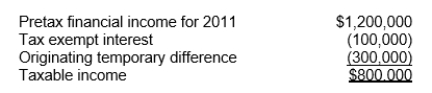

-Watson Corporation prepared the following reconciliation for its first year of operations:

The temporary difference will reverse evenly over the next two years at an enacted tax rate of 40%.The enacted tax rate for 2011 is 28%.What amount should be reported in its 2011 income statement as the current portion of its provision for income taxes?

Definitions:

Frequent Coughing

The act of expelling air from the lungs with a sudden sharp sound, occurring often, possibly as a symptom of a respiratory condition or disease.

Pulse Oximetry Reading

A non-invasive measurement of the oxygen saturation level in the blood.

Adequate Tissue Oxygenation

The sufficient delivery of oxygen to tissues in the body, essential for cellular metabolism and overall health.

Alveolar-Capillary Gas Exchange

The process by which oxygen is taken into the body and carbon dioxide is expelled, occurring across the alveolar and capillary membranes in the lungs.

Q1: Hayes Construction Corporation contracted to construct a

Q2: Stephens Company has a deductible temporary difference

Q7: Unruh Corp.and its divisions are engaged solely

Q7: Companies should recognize revenue when it is

Q14: Stone Company changed its method of pricing

Q39: What amount of cash was paid on

Q42: The net cash provided (used) by financing

Q50: Which of the following should be shown

Q66: In preparing Titan Inc.'s statement of cash

Q87: A corporation is incorporated in only one