Use the following information for questions.

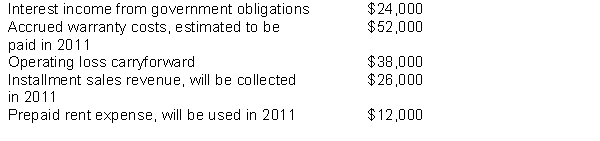

At the beginning of 2010; Elephant, Inc.had a deferred tax asset of $4,000 and a deferred tax liability of $6,000.Pre-tax accounting income for 2010 was $300,000 and the enacted tax rate is 40%.The following items are included in Elephant's pre-tax income:

-What is Elephant, Inc.'s taxable income for 2010?

Definitions:

Competitive

Characterized by or showing a strong desire to be more successful than others.

Operating Procedures

Standardized methods and processes designed to consistently carry out day-to-day tasks and operations.

Management Programs

Structured plans and initiatives implemented within an organization to achieve specific operational, tactical, or strategic objectives.

Flexible Leadership Theory

A management perspective that suggests successful leaders are those who can adapt their style to the demands of different situations.

Q20: Reasons for increased disclosure requirements do NOT

Q47: In determining whether to adjust a deferred

Q48: On December 31, 2010, Kessler Company granted

Q51: If the book have not been closed

Q63: Companies allocate the proceeds received from a

Q64: On December 31, 2011 Dean Company changed

Q73: When preparing a statement of cash flows,

Q73: When treasury shares are purchased for more

Q73: For 2010, what is the amount of

Q99: Equipment purchased during 2011 was<br>A)$510,000.<br>B)$300,000.<br>C)$210,000.<br>D)$90,000.