Use the following information for questions.

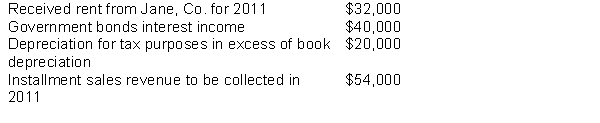

Rowen, Inc.had pre-tax accounting income of $900,000 and a tax rate of 40% in 2010, its first year of operations.During 2010 the company had the following transactions:

-For 2010, what is the amount of income taxes payable for Rowen, Inc?

Definitions:

Coerced

Being forced or compelled to act or think in a certain way through pressure, threats, or intimidation.

Self-Concepts

Self-concepts refer to the collection of beliefs about oneself, including attributes, roles, goals, and competencies.

Sophisticated

Having a refined knowledge of the world, complex in design or development, or showing advanced skills and understanding.

Comprehensive

Involving an all-encompassing or complete approach, taking into account all or most factors, variables, or aspects of a situation or problem.

Q1: If an IASB standard creates a new

Q16: On May 1, 2012, Payne should record

Q31: The amount that Ventura should report for

Q32: The total effect of the errors on

Q35: A company using a perpetual inventory system

Q62: The revenue recognition principle indicates that revenue

Q63: Kraft, Inc.sponsors a defined-benefit pension plan.The following

Q64: At December 31, 2010 Raymond Corporation reported

Q73: The requirements for disclosure are the same

Q85: After the lessor establishes the payment, there