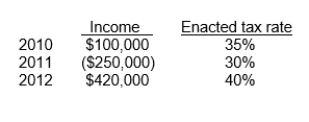

Use the following information for questions.

Operating income and tax rates for C.J.Company's first three years of operations were as

follows:

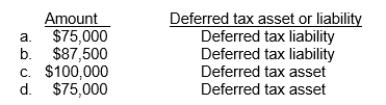

-Assuming that C.J.Company opts only to carryforward its 2011 NOL, what is the amount of deferred tax asset or liability that C.J.Company would report on its December 31, 2011 balance sheet?

Definitions:

Add Field

The action of inserting a new data field into a database, form, or application to capture more information.

New Field

An additional column or entry space defined in a database or spreadsheet for storing specific pieces of data.

Insert Field

A command used in software applications to embed dynamically-updating or user-specified information into a document.

Quick Access Toolbar

A modifiable toolbar within Microsoft Office programs that offers quick access to commonly utilized commands.

Q9: At December 31, 2012 Cooper would report

Q22: Although ASPE does NOT offer guidance for

Q28: Gains and losses that relate to the

Q38: Net cash flow from operating activities for

Q47: The interest on the defined benefit obligation

Q65: Non detachable warrants, unlike detachable warrants, are

Q65: Companies account for transfers between investment classifications

Q69: Companies must periodically review the estimated unguaranteed

Q71: Preference dividends are subtracted from net income

Q84: Mingenback Company has 560,000 shares of $10