Use the following information for questions.

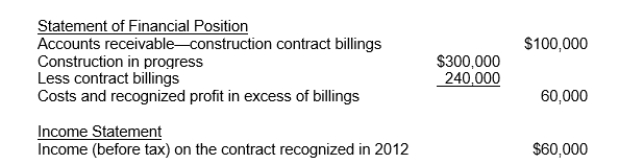

In 2012, Fargo Corporation began construction work under a three-year contract.The contract price is $2,400,000.Fargo uses the percentage-of-completion method for financial accounting purposes.The income to be recognized each year is based on the proportion of costs incurred to total estimated costs for completing the contract.The financial statement presentations relating to this contract at December 31, 2012, follow:

-What was the initial estimated total income before tax on this contract?

Definitions:

Q7: From the lessee's viewpoint, what type of

Q15: Yancey, Inc.would record depreciation expense on this

Q25: A reconciliation of Gentry Company's pretax accounting

Q32: The conversion of preference shares may be

Q35: Lark Corp.has a contract to construct a

Q50: For counterbalancing errors, restatement of comparative financial

Q54: What is the amount that Cooper Enterprises

Q59: Percy Corporation was organized on January 1,

Q72: The features most frequently associated with preference

Q103: If Alt accounts for the lease as