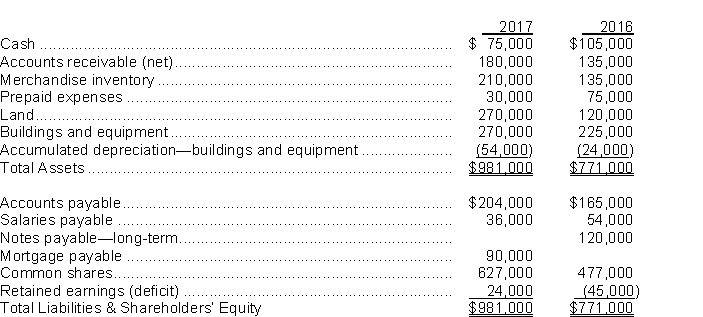

The statements of financial position for King Lear Corp.at the end of 2017 and 2016 are as follows:  During 2017, land was acquired in exchange for common shares (which had a market value of $150,000 at the time) .All equipment purchased was for cash.Equipment costing $15,000 was sold for $6,000 cash; book value of the equipment at the time of sale was $12,000, and the loss was included in net income.Cash dividends of $30,000 were declared and paid during the year.King adheres to ASPE and uses the indirect method when preparing the statement of cash flows.The cash provided by operating activities for calendar 2017 was

During 2017, land was acquired in exchange for common shares (which had a market value of $150,000 at the time) .All equipment purchased was for cash.Equipment costing $15,000 was sold for $6,000 cash; book value of the equipment at the time of sale was $12,000, and the loss was included in net income.Cash dividends of $30,000 were declared and paid during the year.King adheres to ASPE and uses the indirect method when preparing the statement of cash flows.The cash provided by operating activities for calendar 2017 was

Definitions:

Q23: At December 31, 2016, Marion Inc.had 6,000,000

Q31: In a statement of cash flows, what

Q32: When is a lease recognized as an

Q32: An auditor's adverse opinion<br>A)although very rare in

Q42: On May 1, 2017, Durban should credit

Q47: When preparing a statement of cash flows,

Q56: When a corporation issues its ordinary shares

Q59: In order to retain certain key executives,

Q59: Complex financial instruments make the distinction between

Q98: An analysis of equity of Hahn Corporation