Use the following information for questions.

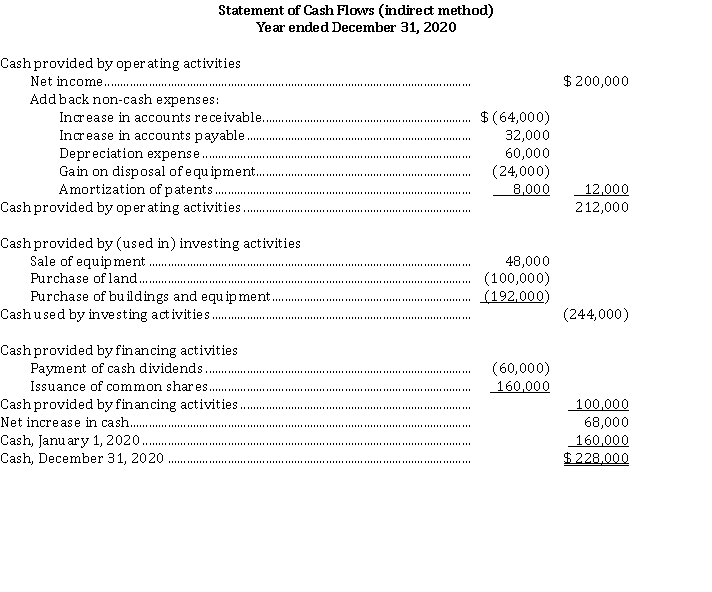

Financial statements for Bernard Corp. are presented below:  BERNARD CORP.

BERNARD CORP.  Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

Total assets on the December 31, 2020 statement of financial position were $ 1,108,000. Accumulated depreciation on the equipment sold was $ 56,000.

-When the equipment was sold, the Buildings and Equipment account was credited with

Definitions:

Goodwill

Goodwill represents the excess of the purchase price paid for an acquired company over the fair value of its identifiable net assets at the time of acquisition.

Equity Method

An accounting technique used to record investments in which the investor has significant influence over the investee, recognizing their share of the profits and losses.

Indefinite Useful Life

An intangible asset with an expected life that extends beyond the foreseeable future, not requiring amortization but subject to annual impairment tests.

Acquisition Differential

The difference between the purchase price of an acquired entity and the fair value of its identifiable net assets.

Q14: At December 31, 2017, Barium Corp.had 500,000

Q18: On April 7, 2012, Kegin Corporation sold

Q24: The rate of return on ordinary share

Q24: Under IFRS for employee future benefits besides

Q28: When valuing financial instruments at fair value

Q30: The total effect of the errors on

Q43: A lessee reported a ten-year capital lease

Q50: At December 31, 2016, Tantalum Corp.had 300,000

Q103: The declaration and issuance of a share

Q111: On December 31, 2016, the shareholders' equity