Use the following information for questions.

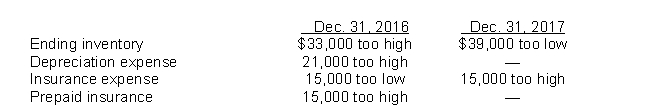

Fairfax Inc.began operations on January 1, 2016.Financial statements for 2016 and 2017 contained the following errors:  In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

In addition, on December 31, 2017 fully depreciated equipment was sold for $7,200, but the sale was NOT recorded until 2018.No corrections have been made for any of the errors.Ignore income tax considerations.

-The total effect of the errors on Fairfax's 2017 net income is

Definitions:

Fortune

A large amount of wealth or prosperity, often used to describe the extensive assets of an individual or entity.

Poverty Rate

The percentage of the population that lives below the national poverty line, indicating the proportion of individuals living in poverty.

Billion

A numerical value represented as 1,000 million in the American short scale, commonly used to denote a significant quantity in financial and demographic contexts.

Declined Steadily

A consistent decrease in quantity, quality, or value over a period of time.

Q3: IFRS requires that convertible debt be separated

Q4: For the year ended December 31, 2012,

Q16: Which of the following is generally associated

Q30: At December 31, 2011, Seasons Construction estimates

Q35: Lark Corp.has a contract to construct a

Q41: Which of the following is a required

Q58: Dakar Inc.has $3,000,000 (par value), 8% convertible

Q62: On July 1, 2017, Salmon Corp.issued $600,000,

Q70: An alternative not available when the seller

Q123: Pryor Corporation issued a 2-for-1 common stock