Use the following information for questions.

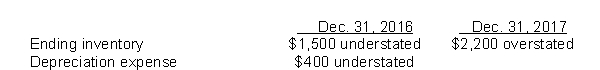

Cheyenne Ltd.'s December 31 year-end financial statements contained the following errors:  An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

An insurance premium of $3,600 was prepaid in 2016 covering the calendar years 2016, 2017, and 2018.This had been debited to insurance expense.In addition, on December 31, 2017, fully depreciated machinery was sold for $1,900 cash, but the sale was not recorded until 2018.There were no other errors during 2017 or 2018 and no corrections have been made for any of the errors.Ignore income tax considerations.

-What is the total net effect of the errors on the amount of Cheyenne's working capital at December 31, 2017?

Definitions:

PowerPoint Presentation

A presentation tool developed by Microsoft, often used for educational, training, or business purposes to visually convey information.

Major Point

The most important or central idea, argument, or piece of information within a discussion or piece of writing.

Question And Answer

A conversational format where inquiries are posed and responses are provided, commonly used in interviews, discussions, and educational settings.

Plagiarism

The act of using someone else's work or ideas without giving proper credit, thereby presenting them as one's own.

Q4: Which of the following facts concerning property,

Q9: Lincoln Company has the following four deferred

Q14: At December 31, 2017, Barium Corp.had 500,000

Q18: Duncan Inc.uses the accrual method of accounting

Q29: The total lease-related expenses recognized by the

Q34: Which of the following is generally NOT

Q40: In calculating depreciation of a leased asset,

Q44: On April 7, 2017, Soweto Corp.sold a

Q93: At the beginning of 2011, Hamilton Company

Q94: Total shareholders' equity represents<br>A)a claim to specific